Once you solidify your business idea, learn about the basics and register LTD in Companies House, it’s time to handle the cash flow. From where and how payments for services and products will be coming to you? Where will you keep business funds? How to manage and move them to your private account? This article is just about that.

Tech is here to help

We are living during a fabulous period of ubiquitous, inexpensive and easy-to-use technology. I’m a supporter of digitalization, minimization and sharing knowledge because I understand how influential were computers, internet and mobile devices for my career and self-development. The way I run my finances is also inseparable from technological achievements. The following guide is focusing on those, who feel confident in the digital world and want to develop business with the best solutions.

Disclaimer

Similarly, as in the introduction to LTD in the UK, I need to emphasize, that everything written here, is just my experience. Like everyone, I can be wrong and there could be errors in the text. All actions you decide to do after reading this article are your responsibility.

Additionally, the dynamics of the global finance world is so fast, that even if I try, I cannot guarantee that the following information is up-to-date.

Before you pay

Regardless of which products will you use, each of them is offered by a company, that employs people and families dependent on that business. Goods and services trading is older than most of the countries, cultures, and political systems, but it always goes down to humans, who offer their skills and products to help others. It’s worth remembering that behind each company stands a living and sensitive being.

On the same token, the financial market is always attracting mountebanks, tricksters, and archaic institutions, that charge high fees only to justify its existence. Therefore, besides common sense, you must equip yourself with additional armor of patience and perseverance. Constant learning and experimenting with all available tools will be an indispensable part of your business development.

Before you set up a bank account or pay for any service, make sure that you have an answer to the following questions:

- What kind of problem in your company this service solves?

- How much this service costs (yearly/monthly) and do I have secured funds to pay for it?

- How does the resignation process look like and how to transfer to another service?

Basic requirements for all business financial products

In the following paragraphs, I describe my approach to any financial products used in Nerd on Tour LTD. Keep in mind, that my company operates in tourism and IT. I work remotely as a freelancer/digital nomad. Therefore the tips are most helpful for these kinds of professionals. If you require a specialised consultation – reach experts.

Converting dollars to shillings

The articles series LTD in the UK is focusing on entrepreneurship in Great Britain, yet it doesn’t mean that my services, customers and business relations are focused on pound sterling. As a freelancer, I work globally with anyone who uses English or Polish. In practice, I buy and sell services using a variety of currencies in different markets.

Currency conversion is a key issue and will be valid as long as we use different money. Even if you focus only on one market, for example – Europe and all your prices are in Euro, your customers from countries of other currency (like Poland, Sweden, Croatia) will always convert to the money, they are accustomed.

Therefore conversion is a rate between two currencies + middleman fee. The middlemen can be:

- card payment issuer – e.g. MasterCard, Visa, Amex, JCB,

- online payment operator – e.g. Stripe, PayPal, PayU,

- bank – City Bank, ING, Barclays.

The mid-market rate is an average currency rate publicly accessible for anyone. Unfortunately, middleman fees and the conversion policies are not as accessible. If it’s not clearly stated in the terms of service, I recommend reaching out to the customer support.

How easy and fast it works?

The web design, convenient mobile app and server stability of a financial product is as important as their security standards, certifications and fee policies. I trust companies that at can polish to the same degree their product, appearance and ease of use.

For example, a bank account is a popular product, that every modern company need to have in order to conduct business. For me, the design is not a catalogue with smiling celebrities but clarity and simplicity in finding right info on a website or in the online dashboard. This is also a mobile app, that once configured allows me to: check transactions, send payments and reach support. The padlock icon in a web browser (TLS encryption) and unlocking an app with biometric readers (fingerprints or face) are world-class security standards, so it’s natural to expect, that they’ll be built-in.

Guarantee of getting back of your money in case of bank bankruptcy (in the UK it is Financial Services Compensation Scheme), fees for running the account, sending international payments, currency conversions and using a debit card are all important details. Triple-check them before proceeding.

Equally important is the speed you can manage the account:

- If you need to call the support, how long are you waiting in a queue?

- Can I email them? If yes, how quick do I get the response?

- While talking via online chat – what is the average time to solve your issue?

- If you send payments from one account to another in the same bank, are they instant?

- What are the incoming payments notifications (SMS, email, push)?

- How quickly I can send national and international payments?

This is how I review every financial product.

Minimize costs and papers

In my years of using a variety of online services, like Google, signing a paper contract was never obligatory. Even when I started with commercial G Suite (Google Apps at that time), the whole business process was done in a web browser and I didn’t need to meet a representative in the office, commute or set up specialised equipment. Everything was done with basic entrepreneur set: computer + internet + electricity.

Moreover, when I turned seventeen and started to work in tourism, I quickly realised what is a limited baggage space. Every backpack, messenger bag or suitcase I tirelessly carried were kilograms of “indispensable” equipment. There was never too much space for heavy and taking too much space paper files.

In every business, minimizing costs and paper files look differently. With experience, I learned what is most important in my endeavours. When I experiment with financial products, those are the questions I ask myself:

- Is this service going to automate processes, so I can spend more time for customers?

- Can I at any moment begin or stop using the service? Can I do it online or do I need to file a paper form?

- What is the price of each plan/upgrade in case I need to use bigger resources?

- Is the tech support paid additionally? If yes, how much does it cost and how long it lasts?

- What kind of documents I need to start with this service? Do those documents cost extra money?

- Do they accept scans or do I need to send paper documents via snail mail?

Where to keep business funds?

Setting up British LTD is a simple task, that anyone can do on the Internet. Opening a business bank account is a bit more complex, due to international laws and regulations that constrain the financial industry.

For the sake of an argument let’s see the market of financial products shaped by three main forces:

- Traditional Banks – i.e. British Coutts or global ING.

- Fintech sector – i.e. TransferWise or Payoneer.

- Customers – both private and corporate.

Customer demand for innovation and competition between providers result in a variety of products that help running a business.

Traditional account in British bank

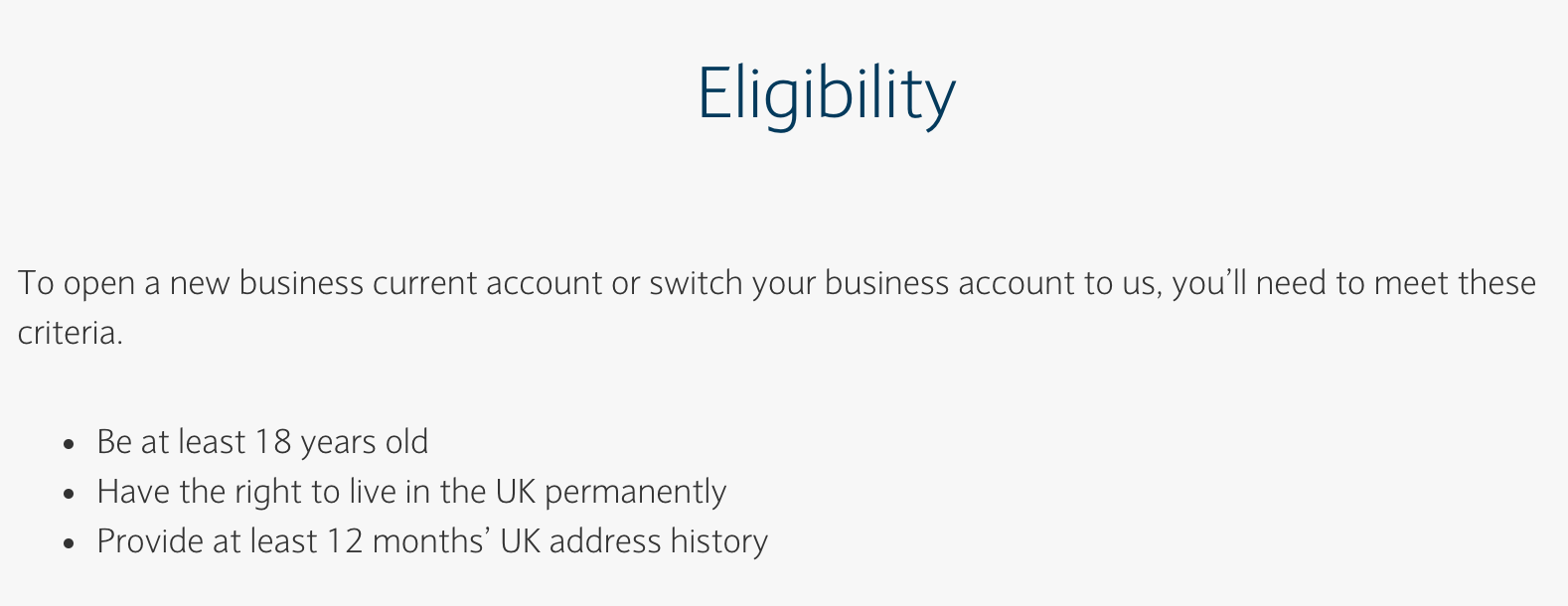

If you are a resident of the United Kingdom, you can freely compare and choose any offer from all British banks. If, like me, you are not a. British citizen but you run a company there, setting up an account in a traditional bank is not possible. Those are the requirements for the account owner, as seen on Barclays’ website:

- Be at least 18 years old

- Have the right to live in the UK permanently

- Provide at least 12 months’ UK address history

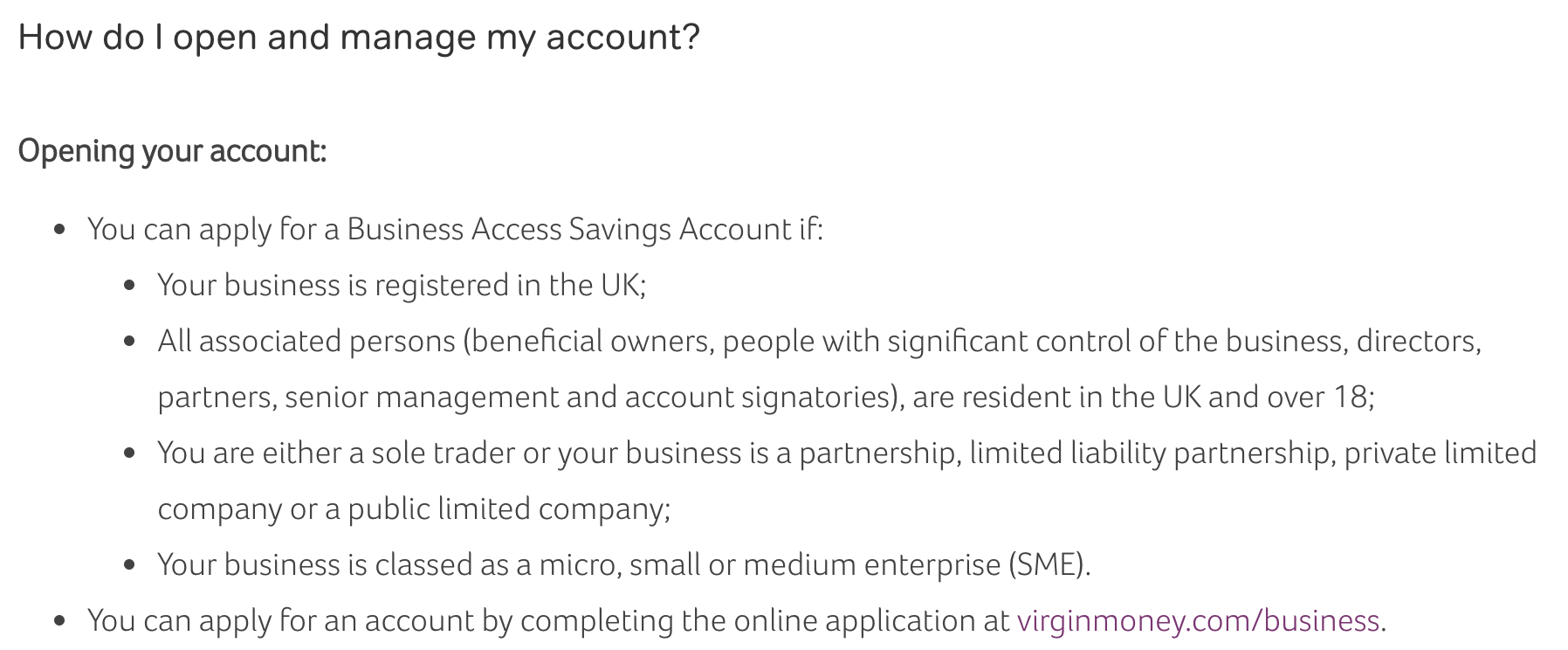

Even Virgin Money, a more progressive bank owned by Richard Branson have similar requirements:

- Your business is registered in the UK;

- All associated persons (…) are resident in the UK and over 18;

Some British accountants can offer running a business account or similar services. This can be useful for big companies. If you are solopreneur or a small team, this will be too expensive. Confirm it by reaching out to experts.

Traditional account in your base country

Hipotethicaly every bank can open an account for a foreign entity. In practice, local bureaucracy, archaic structure and costs such operation can be too high. The only way to test it is to check it by yourself.

For some time in 2015, I was cooperating with a private business school called Asbiro, where I met a few Poles running their British LTD. They were recommending an account for foreign companies in Polish Alior Bank, due to the low fees they managed to negotiate with them. At that time I was comparing offers from other big banks and checking the required documents. This is a translated (from Polish to English) email from Alior Bank employee:

1) Documents that prove your company setup:

the current statement from business registration body or

other government-issued a document with basic company information, its status, representatives, etc.:

a) an apostilled document from the national government organisation or

b) a confirmation made by the Polish embassy or consulate within this business country or by the local notary or

c) a bank confirmation made by the bank that operates this business accounts (…),

2) Documents that prove ownership or representation of any people involved in the business.

Bear in mind that those documents are just a preliminary list – Alior Bank representative can ask for additional documents. Moreover its the representative arbitrary decision to open the account for your business.

Documents in foreign languages need to be filed in original form with translation made by a Polish Sworn Translator or foreign translator (…).

You can open the business account only in our physical branch. It’s not possible to deliver the documents by post or a courier.

Current bank accounts for businesses are dependant on the bookkeeping.

Ultimately, I’ve open this account, but only because of:

- Other entrepreneurs “cleared the path” and confirmed that Alior Bank account helped in their business operations.

- I didn’t need to pay for the Sworn Translator. I bought templates that were used before.

- At that time there was a representative who was willing to open bank accounts for foreign entities in the city of Bydgoszcz in northern Poland.

Do I recommend Alior Bank business account for LTD?

No, due to:

- online banking is archaic and works fine only on computers,

- transition to the new system called “Bank Nowości” takes forever and customer support cannot say when it’ll finish,

- mobile apps were terrible quality, so I almost never used them,

- there’s no two-factor authentication and biometric scans,

- transaction confirmation is done only with SMS, which is not a secure solution,

- conversion rates, are fine, but still much higher than for example in TransferWise,

- international bank transfers are impossibly expensive because they are based on traditional (read archaic) bank system,

- receiving funds from other countries is possible only with IBAN numbers, which is not compatible with British banks (they use Sort Code and Account Number),

- you cannot sync your online banking with accounting services like Wave,

- each debit card is assigned to one subaccount in a specific currency; there’s no way to get one card to control all currencies at once, as in TransferWise or Revolut.

Moreover, there are other factors, independent from banks in Poland:

- The current government is stigmatizing running a company abroad. They use public institutions to scare citizens [page backup].

- Since 2018 law enforcement can freeze any business accounts for 72 hours, without a warrant. Just under suspicion.

- Government Tax Administration office is gaining new privileges to perform tax control in an absence of the taxpayer and also via business-related companies.

- Centralny Mechanizm Oceny and STIR are systems introduced without public consent. Their goal is to monitor internet traffic and look for tax evasions. The intent is good, but such power can lead to tax administration abuse and leaking of sensitive data. Keep in mind that you can easily secure the connection, regardless of where you are, with VPN.

- Running a business is possible with economic freedom. In 2016 Poland dropped down in the Index of Economic Freedom. This is a very troubling trend.

- Komisja Nadzoru Finansowego (Financial Supervision Authority) in an institution that should protect private and business finances. If they work accordingly, Bankowy Fundusz Gwarancyjny (Banking Indemnity Fund) can guarantee bank deposits up to 100 000 EUR. Unfortunately “KNF Scandal” is exposing enormous political influence on those institutions, that should be independent of politics.

- Judicial independence is one of the pillars of democracy. Currently, the Polish judicial system is heavily modified by the ruling government, which is criticised by the European Union.

Video was created by Vox news outlet

For me, it’s enough to look for alternative financial services, outside of Poland.

Fintech account

Fintech is a general term for any company that is combining finance with technology. In most cases, they operate predominantly on the internet and mobile apps, instead of physical branches and red carpets. They offer competitive to traditional bank services, more convenience for users and lower rates for transfers, cards et cetera.

The industry is changing rapidly and it’s always better to verify the fees and policies at the source. Below I describe financial services I successfully use in my British LTD.

Payoneer

The company established in 2005 in New York, that promotes itself as a link between freelancers and online platforms. For example:

- Czech Republic citizen selling his photography on American Gettyimages.

- Philippine citizen creating logotypes on Fiverr.

- Egyptian citizen selling items on Fulfillment by Amazon.

This works also in more complex cases, like mine: Polish citizen, selling services via Stripe, with a company registered in the United Kingdom, who is frequently changing his destinations.

With what I’m satisfied:

- no monthly/yearly fees,

- local currencies are managed by the designated banks:

- American dollar (USD) – American First Century Bank,

- British pound (GBP) – British Barclays,

- Euro (EUR) – German Wirecard Bank AG,

- Australian dollar (AUD) – Australian National Australia Bank,

- Canadian dollar (CAD) – Canadian DirectCash Bank,

- Japanese yen (JPY) – Japanese MUFG Bank,

- Chinese yuan (CNY/CNH) – Chinese standard China National Advances Payments System;

- automatic deposits from Stripe in USD and EUR are accepted without issues,

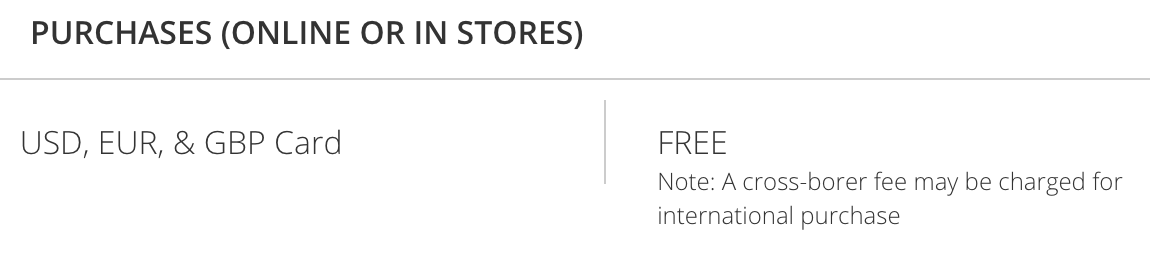

- debit MasterCards in USD, EUR, GBP work everywhere where MasterCard is accepted,

- transfers to local tax collecting institutions are free (including MOSS),

- Payoneer operates for years and grows with the online marketplace industry,

- they are compliance and security certified,

- hypothetically anyone, regardless of the destination and registered company, can use Payoneer services.

What they should improve:

- a complex fee structure for card use in online and physical stores; in fact, additional fees can be collected to any transaction, regardless where the store is located,

- no single card to operate all currencies like in TransferWise and Revolut,

- customer support is on a very low level – answer to any question can last for days, their email managing system is chaotic, there’s no chat option in the mobile app; to reach a representative over the phone or chat in the browser, you need to wait at least one hour,

- web design is archaic and suited only for computers; an additional tab/window is open every time you try to login or check the support pages,

- very limited mobile app with a poor design,

- international transfers are limited only to the local currency, for example to the United Kingdom I can only send British pounds with the Payoneer conversion rate,

- you cannot make a transfer in USD to the USD bank account in TransferWise; Payoneer support explains that the transfers can only be made to regular American bank accounts, not to the e-wallet accounts,

- their business development rate seems much slower than younger fintech companies like TransferWise or Revolut,

- British pound account (GBP) with Sort Code and Account Number is not compatible with Stripe.

Remember that those are my subjective experiences. In general, I’m glad that there’s such solution in the market, that let me minimize costs, integrate and automate with other services. For me, the most important feature is compatibility with Stripe, which is the financial core for Nerd on Tour.

If you create a new account in Payoneer with this link, you’ll receive 25 USD, when inbound transactions pass 1000 USD. It is an affiliate link (programme details) so I’ll also get 25 USD when those requirements are met.

Thank you very much for your support!

TransferWise

Established in 2011 in Estonia, with headquarters in London and branches in New York, Singapore and Tallinn. The company is focusing on international transfers and accounts in the diversity of currencies. Since 2018 they offer a debit MasterCard connected to all your currencies, which is the easiest solution for travellers and entrepreneurs working in many markets.

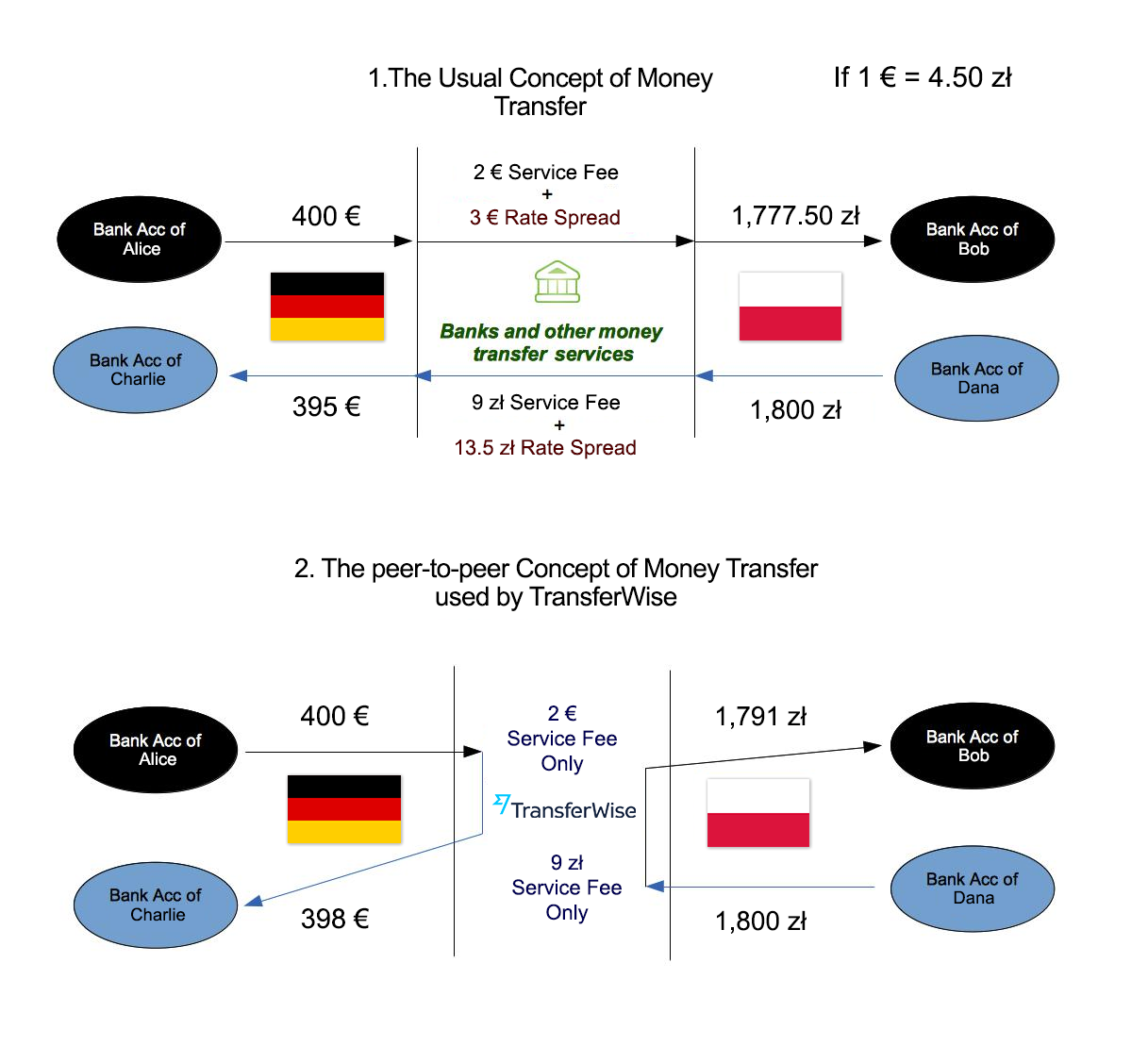

Background history of TransferWise explains how they can offer currency conversion that is not much higher than the official mid-market rate. The one you get when you google “GBP to USD”. Two Estonians were working in the United Kingdom and they were regularly exchanging British pounds to Estonia current currency – Euro. Each transfer cost them about 5% of the transferred amount. To minimize the costs of international transfers, they agreed to pay bills on behalf of the other person inside each country. Over time they expanded the network and created a prosperous business, that attracted many investors, including Richard Branson.

With what I’m satisfied:

- no monthly/yearly costs,

- low and clearly stated fees before submitting bank transfers or currency conversions,

- major currencies are operated by banks in corresponding countries,

- you can accept regular bank transfers from companies and people in USD, EUR, GBP and AUD,

- one debit MasterCard to operate all your currencies,

- when you don’t possess local currency TW is converting with the lowest rate from the one you have,

- clear and functional web and app design,

- all operations can be done via web and app,

- high and effective security standards – two-factor authentication, biometric lock, login confirmation via app etc.

- very good customer support via chat, email, phone,

- convenient help search in their support pages,

- fast bank transfers with notifications of every step,

- mass payments to employees or invoices to companies (including in multiple currencies),

- integration with outside services with open API,

- oblige to tight international financial regulations,

- impressive business progress and stable position in the marketplace, which is not so common in the world of start-ups/fintechs,

- the business account works under the same profile as your private account – switching between is similar to Google services (icon in the top right corner),

- offer for companies and for personal use is very alike,

- you can accept payments from Amazon Seller Center,

- top-up funds to TransferWise with Apple Pay,

- TransferWise is not a bank, it’s Electronic Money Institution regulated with British Financial Conduct Authority; your funds are kept in Barclays bank, which in case of TransferWise bankruptcy, guarantees refund under Financial Services Compensation Scheme.

What they should improve:

- accepting transfers from Stripe, PayPal, Skrill and other systems that are currently not compatible,

- possibility to open and manage cryptocurrencies like Bitcoin, that was accepted until 2013, but other financial institutions blocked it,

- changing your debit card PIN is possible only in ATMs, which is not the most convenient option; it should be possible inside an app and web,

- accepting transfers from companies and people in other currencies, including PLN; currently, you can top-up money in non-major currencies, only from your private accounts.

I’m very satisfied with TransferWise services. They are the key solution, every time I need to convert currencies for international transfers or pay for online services. Moreover, their debit card is one of the best solutions during travelling. At any moment you can activate the additional account in local currency and buy money or allow the system to automatically convert with the lowest rate.

Additional TransferWise advantage is that you can open your business account for a company from almost any country. Depending on your structure they will require different documents for the verification process, yet they always try to make it fast and simple.

If you create your account with the link above, you’ll get the first transfer up to 500 GBP or equivalent in other currency without TransferWise fee. This is an affiliate link (program policy), therefore I’ll get 50 GBP if at least three people transfer over 200 GBP.

Thank you very much for your support!

Revolut

Established in 2015 fintech came with similar realization as TransferWise – transfers are expensive and are not suited to mobile global citizens. They focused on creating “bank in an app” with free international transfers and debit card that manages all currencies and this approach attracts a lot of new customers.

With what I’m satisfied:

- the mobile app is one of the best I tested – world-class of design, clarity, and ease of use,

- good customer support (via chat in-app and email),

- dispensable virtual debit cards – ideal for online payments,

- no monthly/yearly fees for a private account; business account has a 14-days trial, then you need to pay for the whole year up-front,

- a lot of common operations like currency conversion, international transfers, transfers between Revolut accounts are fee-free,

- mobile notifications show all important info – incoming transactions, payments, conversions; app for business accounts is in beta phase and don’t offer all functionality as the one for private accounts,

- besides standard security measures (biometric scans, payment verification in an app), Revolut offers original solutions i.e. debit card fraud detection based on the GPS location of your phone,

- multiple tariff plans, that increase free transfers limit, ATM withdrawal limit and offer additional services like travel insurance or phone insurance,

- accepting transfers from Stripe, PayPal, Amazon, etc.

- an active user community, that help to polish Revolut services,

- Revolut supports multiple cryptocurrencies,

- top-ups funds to Revolut with Apple Pay,

- pay with Apple Pay – all Revolut cards from personal and business accounts can be added to a compatible Apple device and used for contactless payments,

- mass payments and integration with other services with open API,

- Revolut got a banking license and is currently during organizational transformation. As for now, Revolut is Electronic Money Institution regulated by British Financial Conduct Authority; your funds are kept in Lloyd’s or Barclays, but in case of Revolut bankruptcy, you are not guaranteed a refund under Financial Services Compensation Scheme.

What they should improve:

- card top-ups are limited for private accounts,

- inbound transfers to Revolut can be done only with British (Sort Code and Account Number) or European (IBAN) standards; this can be expensive and time-consuming if you send funds from a traditional bank,

- the business debit card can be sent only to your company registered address; if your virtual office accepts snail mail they should be able to forward you the envelope to any other address,

- information chaos – the online forum for Revolut users/accolades often delivers contradicting statements.

Revolut Business Automations

If you are a programmer, you probably know how to integrate services with API. If it’s not your specialty I’m happy to help you connect Revolut Business with services you already use.

From simple notifications about inbound/outbound transactions sent via email or SMS to specific people, adding records to an online spreadsheet, up to saving changes in your accounting software. All of those integrations work thanks to Zapier automation. I successfully use them in my own company.

Send me an email with what you need to piotrek@nerdontour.net or write a message in the contact form.

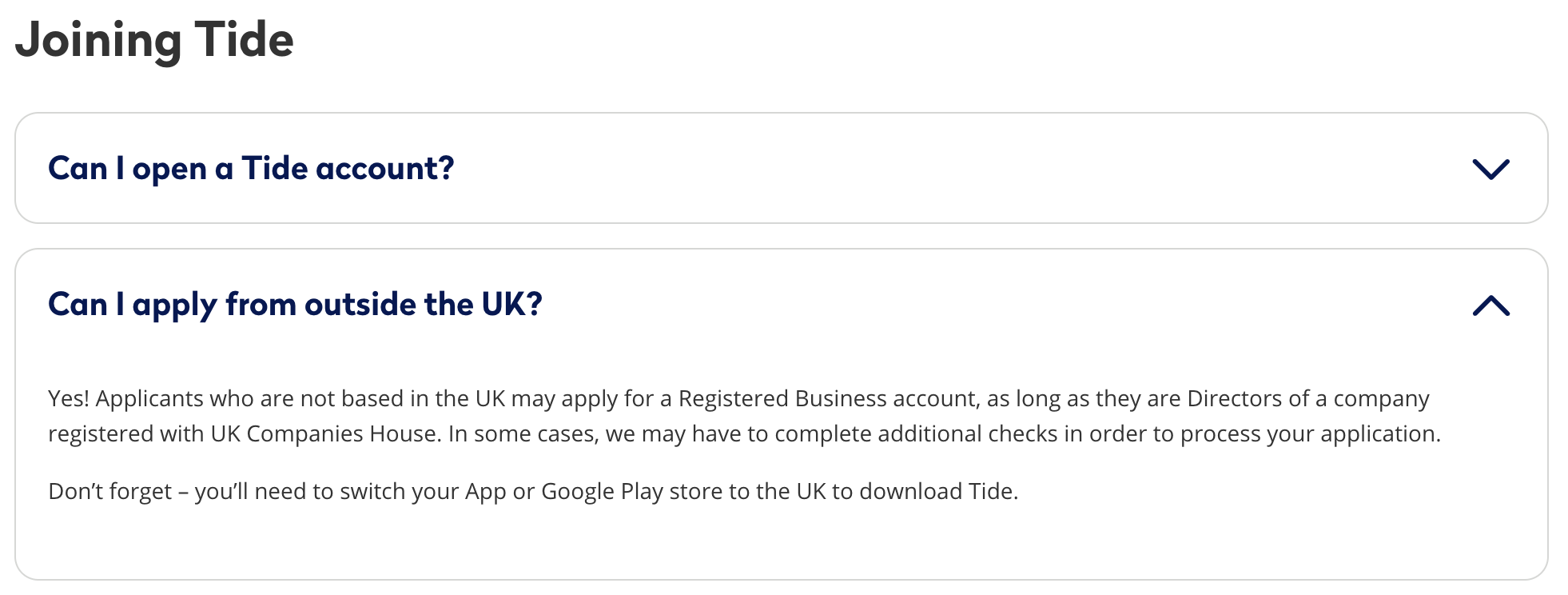

Tide

London service created in 2016 is one of many financial products of Prepay Technologies operating since 2000. Similarly, as Revolut, they create “bank in a phone” with low fees and API integrations. This bold decision attracted many investors.

With what I’m satisfied:

- a business account for LTD can be open if you are a company director; you don’t need to be a British resident,

- good web and app design,

- no monthly/yearly fees,

- good customer support via chat in the app,

- service works the same in an app and via the web,

- easy inbound and outbound transfers inside British bank standard (Sort Code and Account Number),

- compatible with Stripe and PayPal, but only in British pounds,

- quick account registration within the app; they automatically check Companies House registry,

- app secured with a biometric scan,

- integrations with accounting services and other systems with API,

- Tide is a brand owned by Prepay Technologies, who is not a bank, but Electronic Money Institution, regulated by Financial Conduct Authority; your funds are kept on Prepay Technologies account, who in case of Tide bankruptcy guarantees refund under Financial Services Compensation Scheme.

What they should improve:

- currently, Tide operates only within British Faster Payments system; there are no sub accounts in other currencies (you can sign up here to get a notification once they offer it),

- app for iOS and Android can be downloaded only from a British App Store/Google Play; to not cause issues with changing the region on your current Apple ID/Google account I suggest creating separate UK accounts in Apple ID/Google),

- during registration, the form asks about director’s “home address” instead of company “registration address”, which is confusing; after completing all steps, you can clarify issues in the app chat,

- changing the debit card PIN number only in ATM; it should be possible to do also in the app,

- web access requires your phone to access, which is not the most convenient solution,

- account verification only with British mobile phone number,

- the debit card can be sent only to your registration address (trading address); if your virtual office accepts snail mail, they should be able to forward the envelope to any other address,

- unusual debit card – the card number is flat and it’s on the bottom side, right next to your signature space; some places could refuse such card,

- customer support is mainly during European daylight hours; sometimes you need to wait several hours to get the response.

Tide doesn’t offer a public affiliate programme for its customers. The link above is just their site address tide.co. I’ll be pleased if you click it, but no one is getting extra perks.

Without a professional internet presence, you can’t open a bank account

Your web page is your business card. It can be minimal with just your contact info like the name of the company, telephone number, email address, but most importantly it has to be always “within reach”. All the above institutions check, who you are on the internet.

The traditional bank is a huge office in a big city, red carpets at the entrance and a queue of nervously waiting customers. The costs of keeping glamour real estate and an army of representatives are included in the financial products of such banks.

Internet banks (including fintechs) don’t have those expenses, therefore can offer much lower rates. Additionally, they pioneer technological solutions within their structures, which help in competing with traditional banks.

Prove who you are and what your company is doing

In traditional banks, it’s representative, during the live session, who decides to open an account for you (vide the Alior Bank example). In internet banks, everything happens via an app or website. It’s the phase that involves you, as a person.

Company verification happens automatically (like in Tide) or you need to generate in Companies House a PDF company registration certificate (Payoneer, TransferWise, Revolut). Moreover, every fintech wants to validate your internet presence – checking your website and social media profiles.

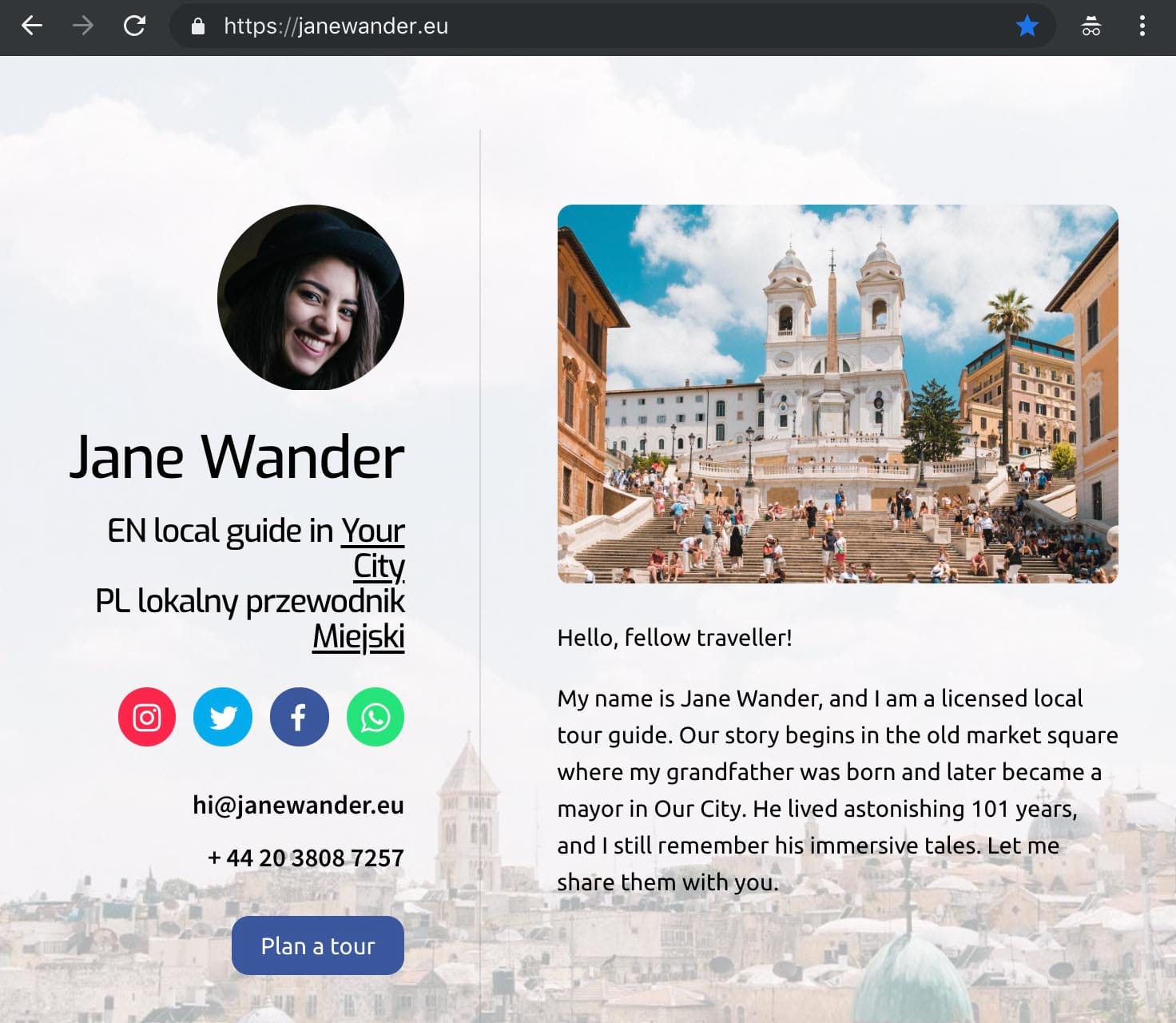

An example of minimalistic business card site, you can use to verify your business is one created by Nerd on Tour: janewander.eu. It includes all basic elements:

- A unique domain address with .eu extension bought for company purposes. It’s not a free domain i.e. janewander.wordpress.com, janewander.blogspot.com, janewander.tumblr.com.

- Secure connection certification SSL/TLS. With that, web browsers can mark the site as safe (green padlock). This also means that sending sensitive information, like telephone number, email address, card payment details are encrypted and you can process online payments (i.e. with Stripe).

- Email address under Jane’s domain – hi@janewander.eu is another proof of her credibility because only Jane can operate this email account. For comparison, anyone can create a janewander@gmail.com account and use it in an unlawful manner.

- Clear design, where you can easily find out relevant info about Jane Wander, what is her profession and how to reach her.

- Icons to social media accounts can quickly show her recent activity, customer relations and her industry connections.

- Phone number with country code and HTML link help to establish a quick call with Jane. Some institutions will want to call you, to further validate your business.

- The site is set on world-class cloud hosting. Thanks to that it loads quickly, despite the device and user location.

Remember that it’s always better to have a simple site with a few lines of relevant info, than not having it at all. Over time you can expand, add sections, offers, photos, etc. Social media accounts work quite similar. It’s better to polish one place i.e. Instagram and gradually expand to other platforms.

You can’t open Tide account without a British mobile

On one hand Tide is removing the British residency requirement to set up the company account, yet on the other hand, they put other obstacles that could turn down potential customers. Their app could be accessible in App Store/Google Play in all regions.

British mobile number is a second thing that can be problematic for many people. Like other services, they want to associate your number, by sending you SMS with a code. They could easily allow sending a text message to any number with appropriate country code. Alternatively, they could allow landline phone numbers and providing code with voice synthesizer (this is what Google My Business is doing in some countries).

We use VoIP operators in Nerd on Tour, who offer a wide array of landline and mobile phone numbers from all countries and regions. Besides verification purposes in Tide, they are useful for answering and establishing international phone calls. Much like in traditional and internet banks, the cost for keeping a number and calling via VoIP is much lower than in regular phone operators.

Moreover, VoIP is fully compatible with other online services. With it, you can get SMS as emails, set business trading hours when you want to receive calls or forward them and saving voicemail messages in the cloud. You don’t require dedicated devices to use VoIP. Your current smartphone/computer is fully compatible with VoIP services.

Send an email with your VoIP needs to piotrek@nerdontour.net.

If the opening business account is so problematic, maybe I’ll manage it on my private account?

In my introduction to LTD, I described that there’s a clear distinction between a person and a company, even if both entities are named the same. This is a form of protection for you and your finances from the bankruptcy of your endeavour. That’s why you should not abuse such privilege:

- Keep in mind that your British accountant is your first line of defence in relations with Her Majesty’s Revenue and Customs – HMRC and Department of Work and Pensions – DWP. If your financial structure is doubtful the accountant can refuse to work with you.

- Even if you have few inbound/outbound operations per month, with your business development they’ll increase. Separating personal and business accounts from the very beginning will help you with annual reports and summaries.

- Regardless if you offer your services to people or companies, accepting money to your private account will cause suspicion. Also, money operators like Stripe, will not allow you to transfer funds to your private account.

How to accept payments to LTD in the UK?

During seminars and meetings regarding LTD, accepting cash in the company was not advised. It’s even more problematic, when like in my case, the work happens not in the physical location in the UK, but rather in many countries or on the internet.

Why bank transfers are the preferred method of bookkeeping in a company?

- Every transaction is automatically described – there’s date, value, name, sender. It’s especially important during annual reports.

- Banks that participate in the transaction, verify details of sender and receiver. With that, it’s easy to correct mistakes and send the transfer again.

- Both sides are getting transaction statements. In case of failure, it’s easy to check the records.

Above institutions are making electronic money management really easy. Of course, with debit cards paying for products or withdrawing cash in any ATM on the globe is even more convenient.

Accepting transfers to a business account

Regardless of where you’ll decide to keep the business funds, it’s important to remember that every currency conversion is a loss. The best solution is to accept inbound transfers in native currency. If your service is in Euro, the inbound should be directed to the subaccount in this currency. If it’s not possible, always minimize conversion costs – choose services that offer the lowest fees.

Accepting payments via money operators and online marketplace

As I underlined in the introduction article, having a British LTD opens a gate to the whole world. It means that regardless of your physical location, you can offer services and products in all marketplaces and platforms. It’s worth working with online money operators to make payments convenient for potential customers and to receive instant confirmations.

Stripe – the best money operator

I’m an avid gamer and especially action-adventure games like Zelda, Uncharted or Assassin’s Creed inspire me to explore destinations, based on which those games are developed. In 2010 Humble Bundle offered a revolutionary service, where you could get a set of games for “pay as you want” amount. This was my first place to experience the convenience of Stripe payments.

For years I admired Collison brothers, who are building not only the easiest to use and implement payment solution but also a platform with a spectrum of financial products. Loads of companies that work with Stripe and backing up from Google and Elon Musk, result in current company evaluation of over 20 billion dollars.

With what I’m satisfied:

- no monthly/yearly fees,

- a quick and effortless registration process for a business account,

- clear and readable fee policy – you pay for Stripe only if the transaction was successful,

- amazing customer support available 24/7 via mail, chat and phone,

- world-class design of web and app, that shows only the most relevant info in any given moment,

- integration with over one hundred payment systems that are created for local markets i.e. Alipay for China, P24 for Poland, Giropay for Germany,

- possibility to negotiate fees, when your company have a high income or unusual transaction records,

- accept payments in over 135 currencies; with that, it’s easier to convince them to pay,

- instant email and push notifications about transactions,

- impressive amount of compatible services, that help run your business, including WordPress plugins, e-commerce solutions, accepting payments from a card without card terminal with Lunatap or making a payment during a phone call with Twilio,

- simple invoice creation for one-time products or regular subscription, automatic emails to customers and charging payments with cards on file,

- Smart Retries feature use machine learning to effectively collect payments from the card,

- Stripe, much like Google and Apple, limits its environmental and climate change impact to a minimum.

What they should improve:

- a faster pace of entering new markets; currently you can create a Stripe account if you run a company in one of those countries,

- you can accept payments in over 135 currencies, but in Stripe Dashboard (for British companies) only the following currencies are compatible; all currencies that don’t have connected bank account are automatically converted into a default currency i.e. USD. List of compatible currencies/accounts in Stripe:

- GBP,

- EUR,

- DKK,

- NOK,

- SEK,

- CHF.

I’m super satisfied with possibilities that Stripe is offering. Independent internet creators, including Pieter Levels from nomadlist.com, are implementing Stripe in their products and services. They do this because Collison brothers put developer needs in first place. With ease of implementation with any app, game or platform, Stripe is becoming the gold standard of internet payments.

Stripe doesn’t offer public affiliate programme. Instead, they offer partner programme for app developers and services that want to collaborate closely and be featured in the list of verified partners. The link above is just: https://dashboard.stripe.com/register.

PayPal

This is without a doubt, the first fintech that offered secure online payments and became a standard in the USA and many more countries around the world. Created in 1998, joined forces with Elon Musk’s internet bank in 2000 and in 2002 was sold to eBay for 1.5 billion dollars. The fortune helped in future successes of PayPal founders, who are known as “PayPal Mafia“.

From the customer perspective, PayPal can be seen as a convenient and secure payment. Unfortunately, there is a number of reasons, why I don’t recommend accepting business payments with PayPal:

- your current PayPal account is attached to the person and to the country where you initially sign up; you cannot create a business account under it (like in TransferWise),

- to create the account in another country, than the one where you are, you need to use VPN, due to the fact that PayPal block by default any attempts to login from “foreign” IP in a web browser,

- you need additional email address for new PayPal account and easy way to switch between them i.e. with password manager,

- high fees and conversion rates depending on where the money is coming from and where they are forwarded,

- money can be withdrawn only to British account with Sort Code and Account Number,

- PayPal can keep on hold your funds up to 90 days, which can be very problematic for many companies,

- there’s a very long list of complaints about how PayPal treats its business partners,

- PayPal offers basic features like payment with an email address, payment button and via a link, but it’s much harder than Stripe to integrate it with other systems.

If not Stripe and PayPal, then what?

There are many companies offering financial products for businesses. Search and test them because depending on your structure, needs and local regulations, you’ll use different solutions than Nerd on Tour. I didn’t use the following services, but maybe at some point, it’ll be worth to compare their offers:

Online Marketplace

Amazon, Shopify, eBay, Fiverr, Etsy, Envato are examples of robust platforms that offer to establish the connection between sellers/freelancers and hundreds of millions of customers. Working with one of those giants gives you chance to reach more customers, but it also means that you need to accept their fees and policies.

Payoneer I described above seems to be compatible with most of those online marketplaces. You should also try to connect TransferWise or Revolut. I’m currently experimenting with few platforms. Once I gain more experience I’ll write a separate article about it.

Combining several accounts and financial institutions

You have total freedom in your money workflow. Depending on what you are offering to whom, you’ll use different solutions.

Example 1

- You have Stripe button on your website.

- Money is transferred from Strip to Payoneer.

- With Payoneer debit card you top-up your Revolut and convert into other currencies.

Example 2

- You are selling products on Amazon.

- Funds are moved to your TransferWise.

- From TransferWise you transfer the money to your traditional bank account.

Example 3

- You create a new PDF invoice and receive money in Tide.

- With Tide debit card you top-up your funds in Revolut.

- Convert money in Revolut and use the virtual card to pay for online services.

Diversification = increased safety

Don’t put all your eggs in one basket

Quote is assigned to Miguel Cervantes, author of “Don Quixote”

This saying is commonly used in the finance world and it also applies to your British LTD. Diversification let you minimize losses when one element of the system doesn’t work as intended. For the increased security of your company I recommend:

- Sing up to multiple bank accounts and fintech companies.

- Get yourself familiar with their features, limits and options.

- Use the one that works for you and in case of any issues, move the funds elsewhere.

How to legally take money from a British LTD?

Once you run separate accounts for you and your company, the next step is to move the funds between them. Before you dive deep into British laws, focus on common sense. If some activity seems doubtful – most likely you shouldn’t do it. This is the same perspective your British accountant will use while creating your financial reports.

Once again I underline, that I’m not a financial advisor, nor a British resident. The following list is a knowledge I gained during seminars and experience I got while working with my accountant since 2014.

Business delegations

This is, in my opinion, the best way for people, often travelling abroad:

- tour managers,

- digital nomads,

- specialist working remotely.

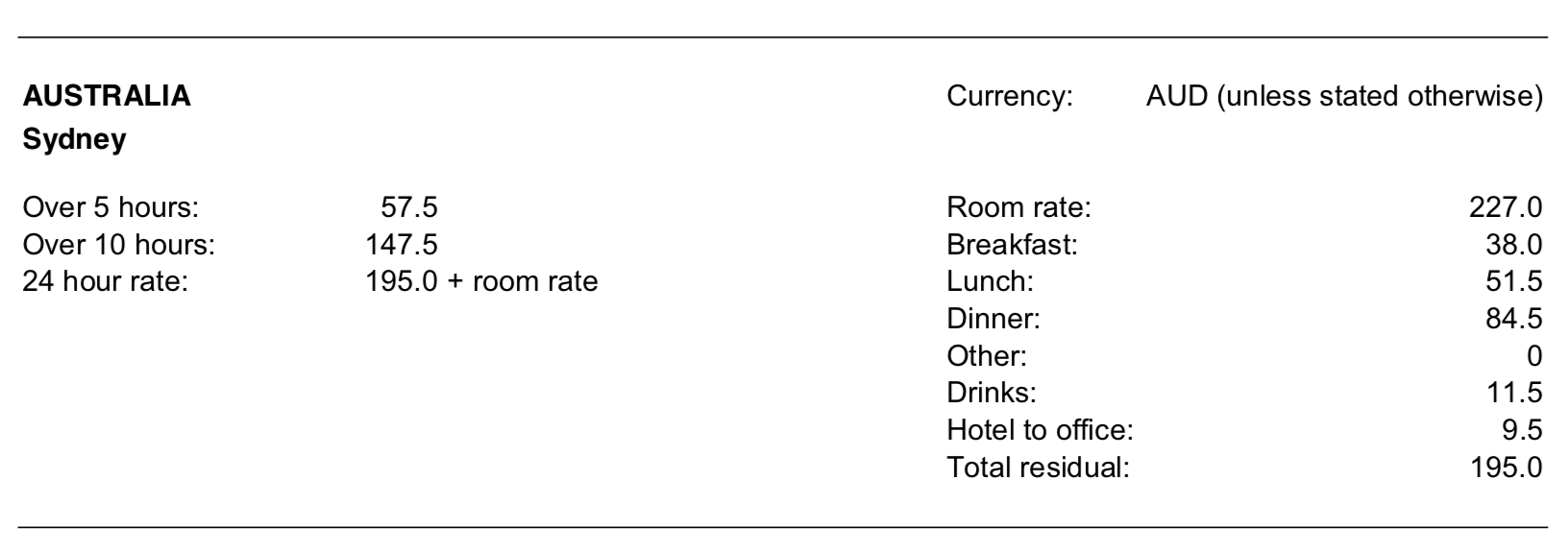

It was often underlined during seminars that business delegations are defined as a “trip outside your base country and outside the United Kingdom”. Use the Scale rate expenses payments: employee travelling outside the UK (on the official gov.uk site) to count the maximum costs for the stay, hospitality, meals and trans.

Business delegations and actual trip costs are based on the invoices or are declared to your accountant. Those costs can be covered only for company directors and employees. There’s no tax added to it because they are costs related to the company activities. Keep in mind, that as always you need to apply common sense.

If your company do 3D modelling and all projects from the last year come from your residential country, a business delegation for three months to another continent can cause suspicions. Yet, if this trip is related to your industry conference, international seminars and meeting with potential customers, which can be easily proved (tickets, invitations), your accountant shouldn’t have any doubts.

Business shopping

What can I buy as a company expense? This is a common question of those who are starting their adventure with LTD. The easiest answer is everything. Plane tickets (as a part of business delegation), computer hardware or crude materials are all examples of business expenses. Your shopping activities should be related to your industry. If you have doubts about any item – reach your accountant.

Those costs can help you minimize your company income tax, but are useful only if the company is registered for VAT. The registration is mandatory only if you crossed 85 000 GBP in annual income (source on the gov.uk site). If the company didn’t cross the annual threshold and is not registered for VAT, it cannot deduct the expenses because there’s nothing to deduct from.

Invoicing third-party companies and freelancers

British LTD can be the “mother” company with branches in other countries. In this structure, invoices from branches to the mother company can be seen as one of the legal ways of transferring money from the LTD. Of course, remember about the common sense, international regulations and taxes for products and services. It’s best to consult an expert before setting up such a structure.

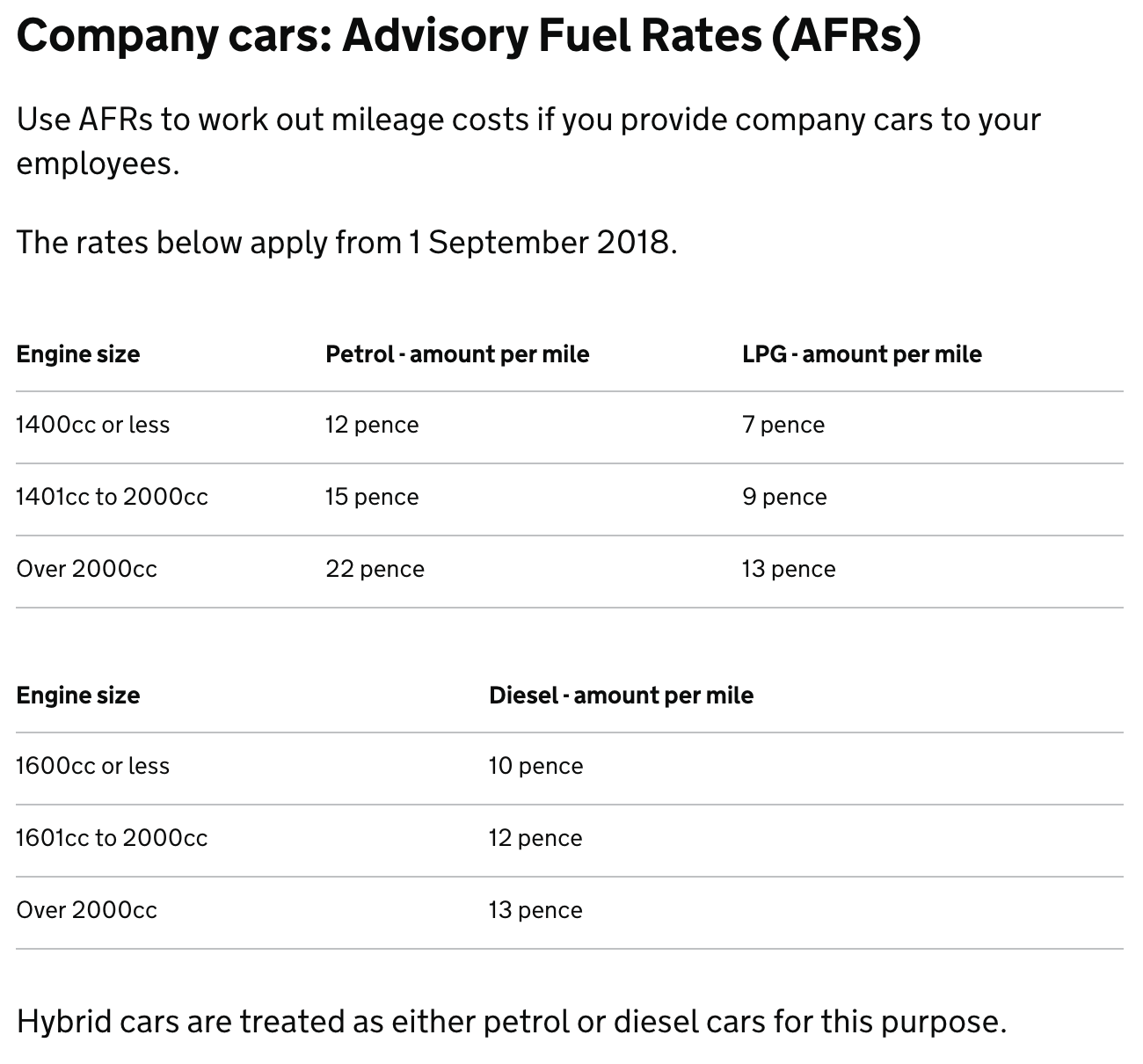

Travelling by car

It’s a great solution for those who often travel by the company car. It’s easy to apply the Advisory Fuel Rates (AFRs) and pass it to your accountant if you are based in Great Britain. If you want to apply AFRs abroad or in your base country, be aware of the following:

- rates are set in the British standard (miles and pounds),

- a “company car” and private use of it can vary, depending on the country,

- currency conversions and company car registration can cause more issues than benefits.

I don’t use AFRs in my work, therefore, I never pass it to my accountant. Consult experts in the field.

Director and employee salary

If you are a company director, you don’t need to receive a salary to work for the company. You need to pass formal requirements if you would like to receive it. The most important one is the NIN – National Insurance Number. If you are a British citizen, you probably have the number already.

Foreigners can get it if they want to stay in the United Kingdom. Some British accountants offer help in getting it, even you are not a UK resident. Mind the service costs and visit UK and interview with a government representative. The same procedure applies to all your employees.

I don’t have NIN and I don’t receive a salary from my LTD. To know more – reach experts.

Other legal ways for withdrawing funds from a company

This article describes general information about money flow in British LTD. There are directors loans, SEIS method of investing in other companies and retirement pensions gathered from the salary. I’m sure you can find other legal methods to do so. As always, I recommend checking official sources.

Easy Invoicing for LTD in the UK

Regardless if you file one invoice a year or mass produce it every month, it’s better to use easy and fast software that can help you from the very beginning and works everywhere you go. Since 2014 I tested a couple different solutions, but only those below are worth to recommend.

Wave

Canadian company works since 2009 and focuses on small businesses. Their free service attracted millions of customers from around the world and investors, who see great perspectives for companies like that.

With what I’m satisfied:

- clear and professional web and app design,

- all necessary info can be found on the support pages,

- initial registration, filling company details, adding customers, generating one-time and recurring invoices is intuitive and well designed,

- Wave can automatically generate PDF invoices and send it as an attachment from your company email address,

- the free mobile app has all basic features so you can manage invoices on-the-go,

- in the “notes” field you can add any text, including details for regular bank transfers,

- generated PDF invoices look professional and are ready to be archived or print (if necessary),

- automatic tax rates summary and the total amount of all items on the invoice,

- web and app works smoothly and error-free anywhere on the globe,

- easy integration with N26, Payoneer, PayPal and over 10 000 banks/financial institutions to automatically record payments,

- Zapier compatibility to create unique automation,

- all the above features are offered for free; Wave gains money from the optional card payments.

What they should improve:

- compatibility with Stripe or other money operators to automatically record payments,

- integration with more banks around the world; this could possibly change when all financial institutions in Europe switch to PSD2/Open Banking.

Wave doesn’t offer affiliate programme. The link above is just: https://my.waveapps.com/register/.

Simple Invoices

It’s a service as simple as Wave, that works only in the web browser. With flat monthly fee allows to generate unlimited amount of invoices and accepting payments with Stripe or PayPal. Simple Invoice doesn’t offer public success records. Nevertheless, Canadian developer Deon Don looks a guy with proper experience to create this service.

The 14-days trial allows using all the features. After that, you need to pay a monthly/yearly fee.

Simple Invoice doesn’t offer affiliate programme. The link above is just: https://simpleinvoices.io/signup.

Stripe Billing

Stripe is a very detailed product, that’s why I also use it to generate invoices. Billing is one of the features visible inside the Stripe dashboard. The design is not as clear as in Wave or Simple Invoice, but with trial and error, you can get what you want. Even if you are not a programmer.

The best part is that Stripe Billing is a free and integral part of Stripe. They earn money only if the transaction was successful, that’s why they try their best to improve the service in that direction.

Invoicing Automatization

Wave and Stripe are compatible with Zapier and much like with Revolut Business I can create unique automation for your needs.

Send me an email with what you need to piotrek@nerdontour.net or write a message in the contact form.

Annual and quarterly reports

In fact, this is one of the easiest operations performed in the British LTD. This is just a list of income and costs in a spreadsheet plus PDF invoices. Once a year you send an email with all attachments to your accountant, who prepares the report and forward it to Companies House and Her Majesty’s Revenue and Customs.

Besides the Annual Report, once a year you need to complete the Confirmation Statement, where you mark organisational changes in the LTD. The online form will lead you step by step and in any case, you can reach Companies House Support.

You need to file the Annual Report regardless if the company is VAT registered. Consult your accountant if the company produces more invoices and you need to do reports more often than once a year. Moreover, if you offer online services that are automatically delivered to customers within the European Union, you need to register for MOSS. After that, you need to complete quarterly reports and send money to local governments on the regural basis.

Remember about the income tax!

You pay 20% income tax, every time when your company had profits. This is independent of the VAT registration threshold.

Good luck with your endeavours!

Starting a company in the United Kingdom is like preparing a backpack before a big trip. It seems that you have everything you need, but only during the journey you realise, what is essential. Entering the financial world, your perspective is broadened. You start to discover progress perspective and first customers are helping you polish the vision. They are also a living proof that you do a good job.

Other articles in the series

How can I help?

If you have any questions about British LTD, write them in the comments. I’ll try to answer or point into the right source.

Discussion