If you are nomading, then most likely you already use Revolut or Wise. Their very low exchange rates and global outlook make them ideal travel wallets. About 3 years ago, both companies rolled out nomad-friendly investment products.

What are Wise Interest and Revolut Flexible Cash Funds/Instant Access Savings?

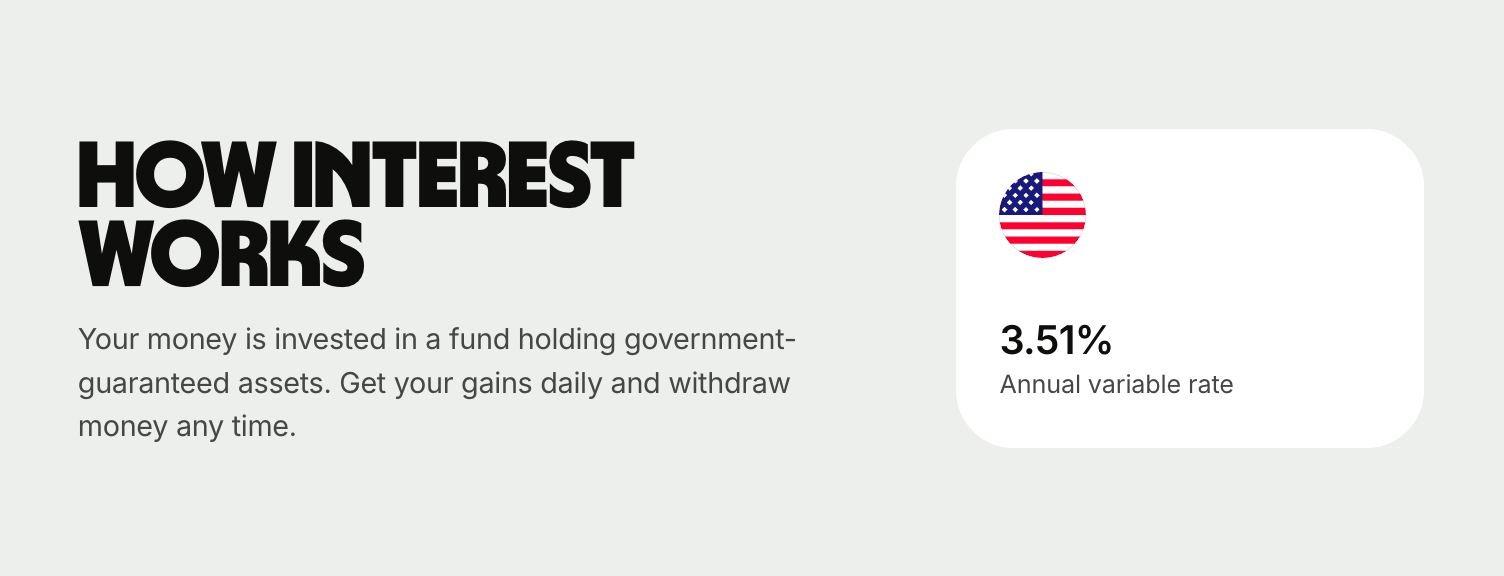

In January 2020, Revolut launched Instant Access Savings. Then Wise got its Interest product in December 2022. Next Revolut launched its Flexible Cash Funds in mid-2024 and Instant Access Savings in. The latter two are operating in money markets: short-term, highly liquid, low-risk securities such as government treasury bills, certificates of deposit, and commercial paper.

Benefits of money market investments

- No lock-up periods

- No minimal investment

- Paid daily

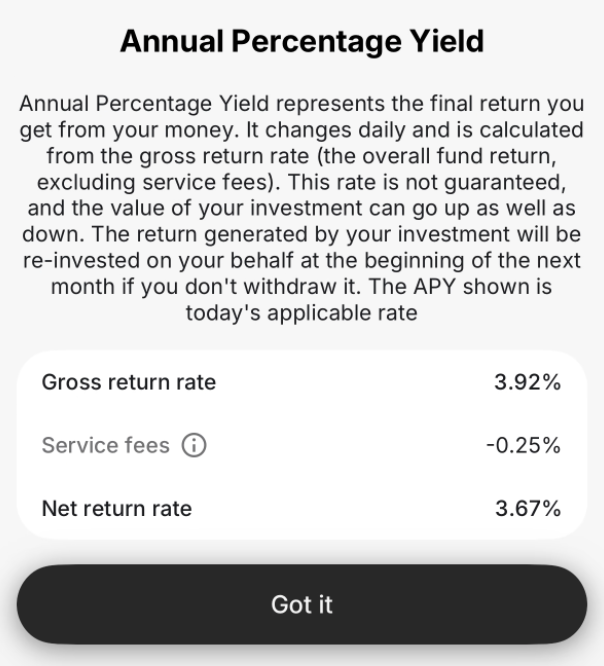

- Very low fees (0.25% to 0.35% annually)

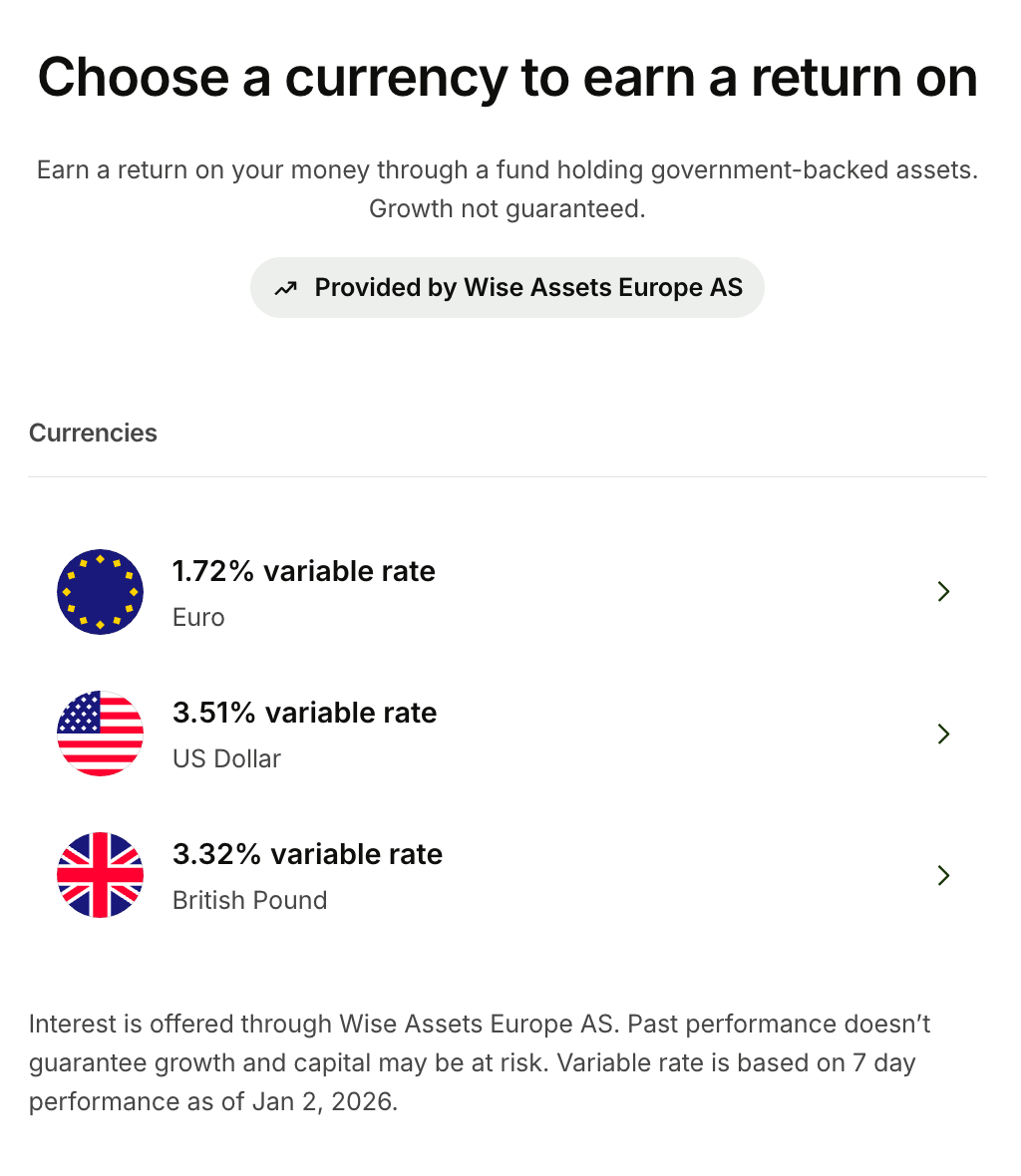

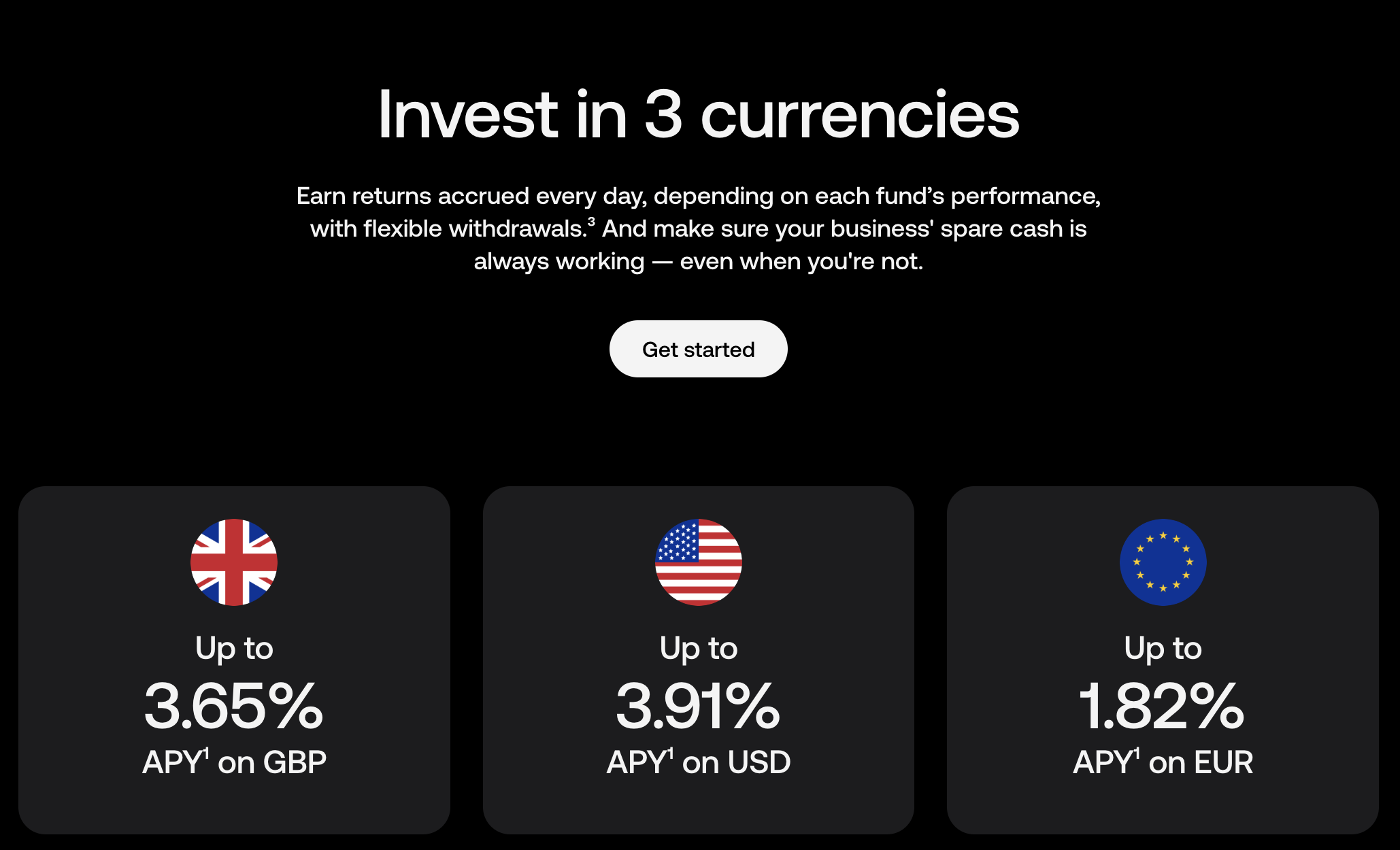

- Ability to invest in USD, GBP and EUR

- Instant deposit and withdrawal

- Quick sign-up right in the app

- Investment insurance

- Yields up to 5.5% (as of Feb 2026)

- Daily payouts

- Easy top-ups from any currency

Disadvantages of money market investments

- Variable rate — you never know how much you'll earn

- Like with any investment, your capital is at risk

Why don't traditional banks offer money market investments?

The short answer is that it's not lucrative enough for them.

Banks generate profit primarily through net interest margin — borrowing from savers at minimal rates while lending at substantially higher rates. Offering competitive money market returns would compress this profitable spread.

Traditional banks maintain extensive physical infrastructure, including thousands of branches, large workforces, and legacy IT systems that create significant overhead expenses.

Revolut and Wise are in the neobanks category. Their management fees are extremely low (0.25% to 0.35% annually). Traditional banks prefer to sell investment products that generate 1% to 2% in fees.

Therefore, traditional banks' margins are neobank's opportunity to address nomad interests even more.

Your margin is my opportunity — Jeff Bezos

Convert currencies to maximize profits

In the beginning, Revolut and Wise were associated with prepaid travel wallets. Because of their exchange fees, which are around 0.4% to 0.6%. This is around 10 times lower than traditional banks at the level of 3-5%.

Considering that the highest yields for money market investments are in USD and GBP, it's best to convert any other currency into these two. When the exchange fees are so low, it's a simple decision.

Easy method to minimize inflation effects

I'm glad with Wise's and Revolut's investment products because of inflation. While it's hard to calculate the average inflation rate for the whole globe, I could do it for the US. In the last 70 years it's around 3.6-3.66%.

Regardless of where your base is, and in what currencies you operate, this is a good indicator. Keeping cash in a regular account loses its value every year. Therefore, keeping this cash in a Wise/Revolut account in USD/GBP can bring you 3.5% or more returns. Minimizing the inflation of my money.

My multi-currency financial nomad setup

Currently, I earn my income in EUR and PLN. My British Nerd on Tour LTD operates Wise Business and Revolut Business accounts. To maximize the returns, I exchange the capital to USD, as this currency offers the highest yields.

Most online services bill in US dollars, eliminating exchange fees. Moreover, Wise Business gives 0.5% cashback for every company card payment. Interest-bearing capital in the money market sits in the same regular account. Shifting funds between locations is unnecessary.

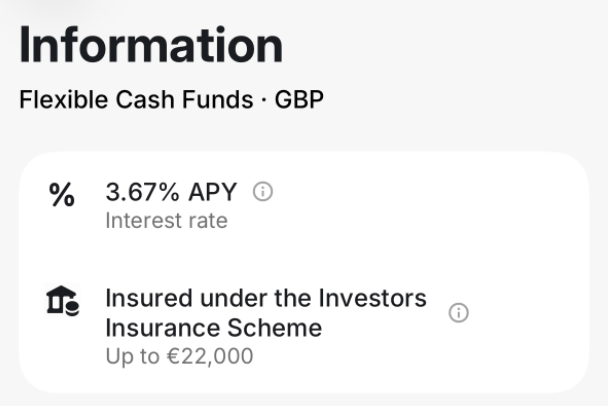

Next, my payouts go from Wise Business to Revolut personal account. I am paying for the Metal subscription plan, which offers higher interest in the Flexible Cash Funds than in the Instant Access Savings. I convert the money to GBP, which at the time of this publication, gives me 3.67% annually. The only downside is that in Revolut, the interest-bearing capital is on a separate subaccount. Therefore, if I want to use some of this money, I need to withdraw it. Or quickly convert it into another currency without extra fees.

Where is it available and for whom?

Revolut Flexible Cash Funds and Wise Interests are available in most markets where their apps are already active. Please note that as with any financial products, the actual yield and availability depend on multiple factors. Local regulations, tax residency, and specific currency market dynamics are among them.

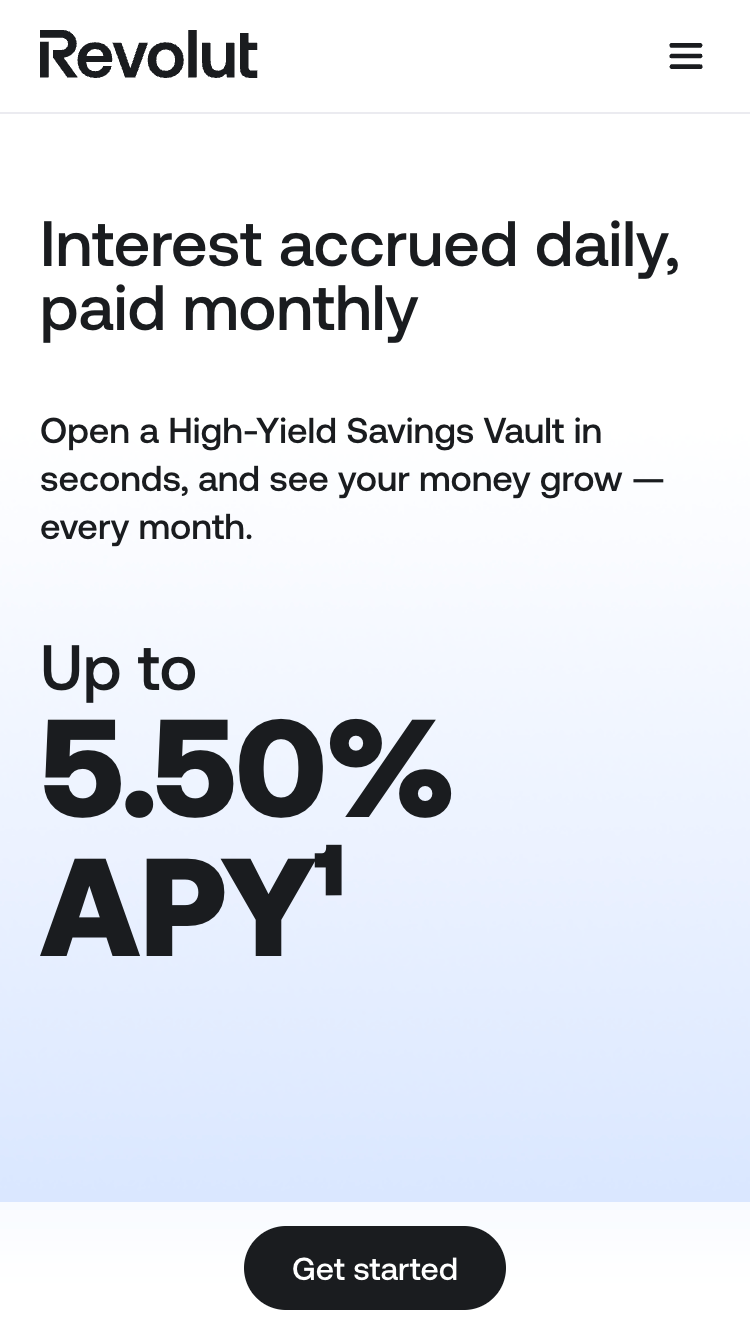

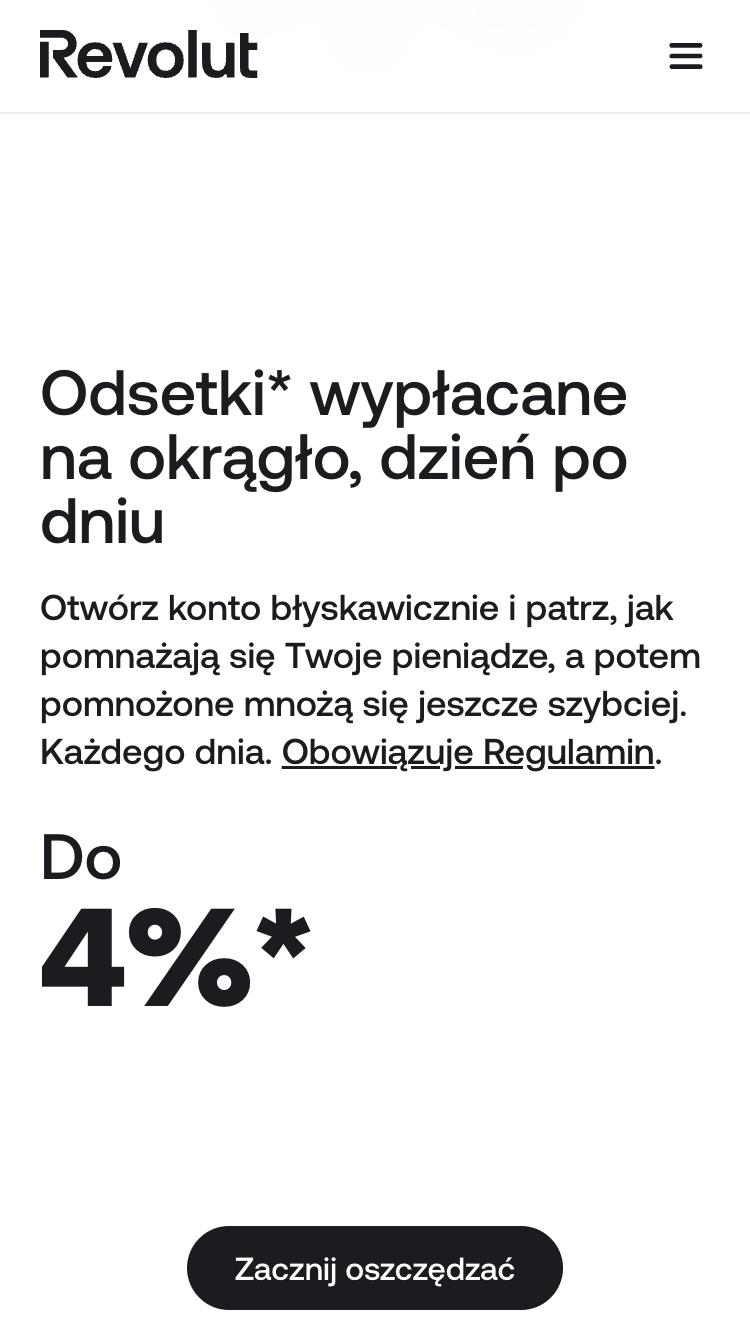

Revolut US offers yields up to 5.5% for USD and Revolut in Poland up to 4% for PLN

Crucially, this offer extends to both companies and individuals. Like in my above case, I can earn interest on my company account and in my personal account.

The best way to check if you and your company are eligible is to log into your Wise or Revolut account and look for Interest or Flexible Cash Funds.

How are these investments insured?

- For US customers, FDIC insurance up to 250 000 USD

- For UK customers, FSCS protection up to 120 000 GBP

- For EU customers up to 20 000, 22 000, or 100 000 EUR depending on the investment product

Check your Wise or Revolut account for details and specific scenarios of the insurance coverage.

Nomad-centric investment product

When I started traveling, exchanging money was one of the biggest hurdles because of high fees. Switching to Wise and Revolut was a major step change. In recent years, investing money became the next enormous challenge. Traditional banks require a lot of paperwork done in person and offer no flexibility around currencies.

Interest and Flexible Cash Funds are another massive improvement for the nomadic tribe. With a few clicks, we can start earning over 3.5% annually, all while wandering around.

This is not a sponsored article. I share my personal experience with the finance apps I use daily. They are my indispensable tools, and they'll be useful for you as well. If you haven't created your Wise | Wise Business and Revolut | Revolut Business account and you enjoy my writing, please use my affiliate links.

Wise Personal and Wise Business

Revolut Personal

Discussion